For more than a century, an American Catholic education has been the mark of a distinctive academic experience. Scientia cum religione, religion and knowledge united, promises an education of the whole person. The Sisters of Mercy founded our school in 1872 to offer a rich Catholic education and formation to children of all faiths, and today, we continue their mission and tradition.

We are committed to continuing the St. Joseph’s Catholic School mission for generations to come, delivering academic excellence and instilling a love of Jesus Christ. Your gift today will build on the generations of donors before you, helping our historic school grow and serve Middle Georgia today and onward.

May God bless you for your faith in education.

The 1872 Annual Fund sustains the immediate operating priorities of St. Joseph’s Catholic School. Began in 2008, the 1872 Fund was created to ensure SJS can support our greatest operational needs for the current school year, including any unexpected expenditures. Like most private institutions, we rely on our annual fund giving to keep the cost of tuition as affordable as possible and to bridge the gap between tuition revenue and the actual cost of an SJS education. Your contribution to the 1872 Annual Fund makes an immediate impact for this year’s students.

Our school is uniquely tied to the history of Middle Georgia through our 150+ year history in Macon. We want to ensure our incredible tradition lives on for generations to come. The SJS Legacy Endowment is our newest fund and is designed to underpin the needs of our school for future decades. Contributions to this fund are invested in full, and the principal balance remains invested. Annually, a portion of the earned interest will be used to support key campus priorities. Your donation to our endowment lives forever as a perpetual gift!

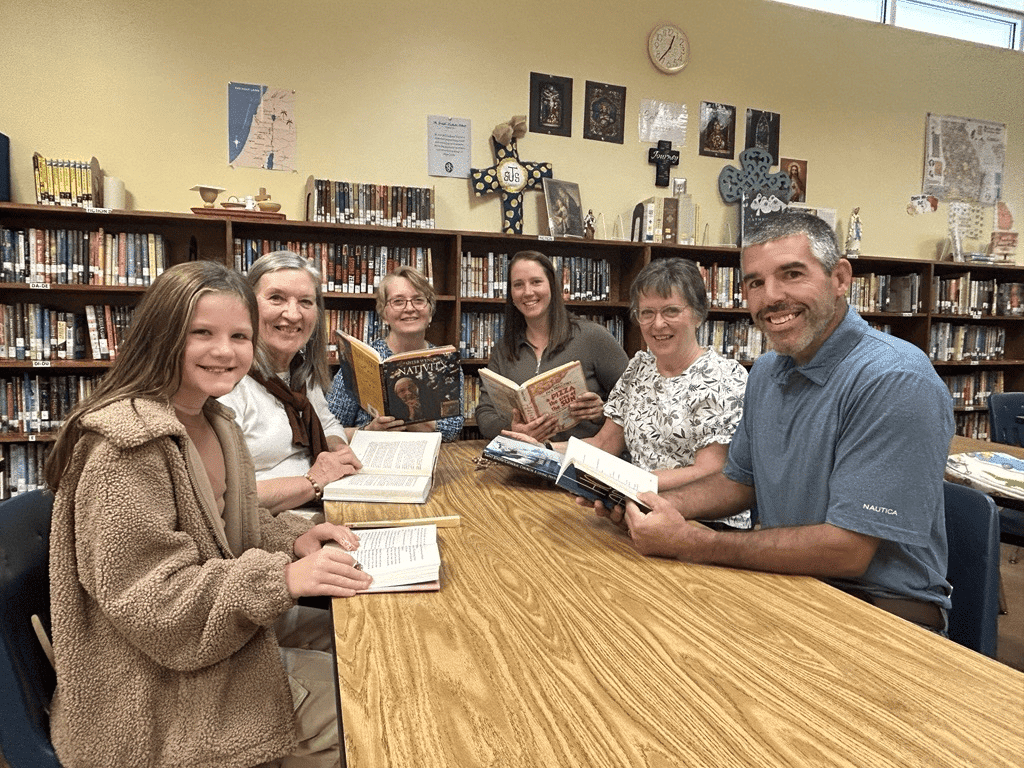

Ms. Jeanne Usher Schoch, beloved educator and friend, taught at St. Joseph’s Catholic School for 15 years. Her passion for reading and phonics transformed how our students learn to read, and her memory lives on through the reading fund founded by her family. Donations to this fund are invested in full, and the interest earned annually is dedicated to the purchase of books, curriculum, and academic materials that promote phonics and early reader success.

The Monsignor Cuddy Fund was established in 1995 in honor of the longtime pastor and shepherd of our St. Joseph Church and School, where he served until retirement in 2004. The Cuddy Fund provides need-based tuition assistance to Catholic SJS students. This fund is a living ministry that honors our Catholic faith and supports our students. Contributions to this fund are invested in full, and the principal balance remains invested. Annually, a portion of the earned interest will be used to provide scholarships. Your donation to this endowment lives forever as a perpetual gift!

Established in 2021 by her family, the Scotty McGoldrick Memorial Scholarship Fund honors the longtime teacher for her many years of service to St. Joseph’s Catholic School. This fund provides need-based tuition assistance to students, with a focus on supporting children of educators. Contributions to this fund support student scholarships.

Every gift makes an impact. With recurring gifts, you can select an amount that’s feasible for you and opt to repeat when you choose (e.g., monthly, quarterly). Setup your donation once and give all year!

The Beall family has been involved, in one way or another, with SJS for generations. We are thankful to carry on the tradition by supporting this great institution. As parents of 3 alums, we are so thankful for the education our children received at SJS, and we want to continue to give back to a school we all love!

Ann Beall

Inside and outside the classroom, we inspire students to boldly imagine, explore, and uncover their passions through sports, the arts, science, technology, and service opportunities. Our Community Partners make it possible to provide after-school activities at low- or no-cost to our students. We welcome community partners all year. Contact our Advancement Office for more information.

You can support SJS through your planned future giving. Planned Giving opportunities allow you to make arrangements now for a future gift of your choosing. Common planned gifts include beneficiary gifts from a will or trust, estate plan, life insurance policy, or retirement fund. Speak with your financial planner to learn more about tax advantages of planned giving, and contact us to learn more.

Did you know many employers will match your donation to SJS? Let us do the research for you! Contact us to share your employer information, and we’ll find out if they can match your gift!

Supporting SJS means a LOT to us, and it can mean a lot you, too. Here are some ideas we’ve seen. What’s important to you?

We’re here to help! For more information about giving, please contact

Brandie Mock

Director of Advancement

brandie.mock@sjsmacon.org

478.259.2031

St. Joseph’s Catholic School, a private school located in historic downtown Macon, Georgia, dedicated to providing a safe and nurturing environment, delivering academic excellence rooted in the teachings of Jesus Christ.

905 High Street

Macon, Georgia 31201

admissions@sjsmacon.org

Tel:(478) 742-0636

Fax:(478)-746-7685

The Georgia GOAL Scholarship Program is a remarkable initiative that enables individuals and businesses to help deserving students access quality K-12 education that may otherwise be out of reach.

All Georgia taxpayers are eligible to receive a 100% state income tax credit in exchange for their contributions to Georgia GOAL. Funds raised through GOAL are used to provide tuition assistance for exceptional students desiring to attend St. Joseph’s Catholic School.

The overwhelming success of the GOAL program speaks volumes about its importance. Year after year, demand surpasses the allocated cap of $120 million within the first business day of the year. This leads to proration of all applications, as witnessed in 2024 when applicants received only 63% of their requested amount due to oversubscription. We anticipate a similar scenario for 2025.

Contribution limits based upon taxpayer filing status are as follows:

Single Filer – up to $2,500

Married Separate Filer – up to $2,500

Married Joint Filer – up to $5,000

Individual Pass-Through Owner – up to $25,000

C Corp, Trust, or Electing Pass-Through – up to 75% of annual tax liability

To secure your 2025 GOAL tax credit, you must submit your application before the end of 2024. Apply today by visiting www.goalscholarship.org. GOAL will handle all remaining steps in the process until your contribution is due in mid-March 2025, within 60 days following approval by the Georgia Department of Revenue.

Help us make the most of this winning program and let’s make every GOAL count! Your participation empowers students to receive an excellent education, supports families in choosing the best educational environment for their children, and strengthens the well-being of our school community.